GEMS: RMD Rules for Inherited IRAs

Understanding the rules surrounding inherited IRAs is crucial for making informed decisions about your financial future. While the regulations can seem complicated, they are manageable with the right guidance and attention to detail. Before 2020, the rules for required minimum distributions (RMDs) from inherited IRAs were relatively straightforward. However, when the SECURE Act was passed on December 20, 2019, we saw significant changes in RMD rules for inherited IRAs. The new regulations were more complex and some of the details were vague. Without added clarification, this has left some inheritors in limbo for several years. On July 18, 2024, we finally received additional guidance from the IRS to clear up the confusion.

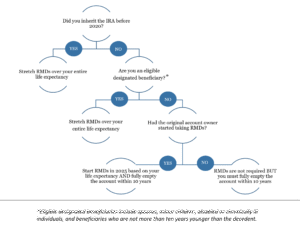

IRAs Inherited Before 2020

The new SECURE Act rules do not apply to IRAs inherited before January 1, 2020. Therefore, if you inherited an IRA prior to 2020, you can stretch your RMDs over the course of your entire life expectancy. This is advantageous to inheritors because it allows more assets to remain in a tax-advantaged account for a longer period of time, potentially even decades.

IRAs Inherited in 2020 and Beyond

With the introduction of the SECURE Act, the RMD rules depend on several factors such as the type of account you inherited, when you inherited it, your relationship to the deceased, and the age of the original owner upon passing.

Eligible Designated Beneficiary vs. Non-Eligible Designated Beneficiary

The first step in determining the treatment of your RMD is to establish if you are an eligible designated beneficiary or a non-eligible designated beneficiary:

- Eligible Designated Beneficiaries: Includes spouses, minor children, disabled or chronically ill individuals, and beneficiaries who are not more than ten years younger than the decedent. This category of heirs can follow the old rules and continue to stretch RMDs from an inherited IRA over their lifetime.

- Non-Eligible Designated Beneficiaries: This group could be subject to the new 10-year rule. This rule states that inheritors must drain the inherited IRA within 10 years after the year of the original owner’s death. However, the law did not specify the pace for pulling the money out. Many wondered if they had to take RMDs or if they could wait until the tenth year to take out all the money. This has now been clarified and is determined by whether the original account owner had started taking RMDs.

RMD Rules for Non-Eligible Designated Beneficiaries

If the Original Account Owner Had Started Taking RMDs

If the original owner had reached RMD age and had started taking RMDs, then you must continue to make RMDs using your own life expectancy factor. Think of RMDs like a faucet. Once the faucet is turned on, it cannot be turned off. The IRS recently confirmed that non-eligible designated beneficiaries must start their RMDs in 2025, if they have not already. In other words, you must take at least the RMD amount each year for the first nine years, and any remaining assets in the account must be fully withdrawn by the end of the tenth year.

For example, if you inherited an IRA in 2021 from someone who had already reached RMD age, then you would need to start taking at least the RMD amounts in the years 2025 to 2030, and then fully withdrawal the account balance by the end of 2031.

You do not need to take retroactive RMDs for the years when we were awaiting clarification. After 2025, there will be a penalty for missed RMDs amounting to 25% of the amount that should have been withdrawn.

If the Original Account Owner Had Not Started Taking RMDs

If the original owner had not started taking RMDs yet, then you do not need to take annual RMDs according to the new rules. Instead, you must simply empty the entire balance of the inherited IRA by the end of the tenth year.

Roth IRAs

The final regulations clarify that beneficiaries of an inherited Roth IRA are not subject to RMDs. This means they do not have to take the money out until the end of the tenth year and withdrawals are tax-free.

Tax Implications and Strategies

It is important to note that withdrawals from an IRA are taxed as ordinary income. With this in mind, there are several strategies that can help you achieve tax efficiency when managing your inherited IRAs.

Inheritors should be mindful of the tax consequences if they take only the RMD each year. Doing so would mean a balloon distribution in the final year. This could tip you into a higher tax bracket and leave you with a big tax bill. As an alternative, you could consider making more even distributions to spread out taxes evenly over the years.

Finally, if you expect your income to drop in the future, you might want to wait and strategically take a bigger distribution in a year when you are potentially in a lower tax bracket.

Conclusion

Clearly the RMD rules for inherited IRAs are complex. We are here to help. We can assist in calculating your RMD amounts and developing the best strategies to manage your inherited IRAs efficiently. Whether you need guidance on the specifics of the new rules or help in planning your distributions to minimize tax impacts, we are dedicated to providing the expertise you need to make the most of your inheritance.

Important Disclosures: This material is provided as a service to you by GenTrust, LLC (“GenTrust”) and is distributed for informational purposes only. The information contained herein is not intended to provide investment, legal, tax or accounting advice. GenTrust does not provide legal, tax or accounting advice. Any statement contained in this material concerning tax matters is not intended or written to be used for the purpose of avoiding penalties imposed on relevant taxpayers. Information contained herein is based on third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed and subject to change without notice. Additional information related to GenTrust, can be viewed via GentTrust’s Form ADV Part 2A, which is available at www.adviserinfo.sec.gov. No part of this material may be reproduced in any form, or referred to in any publication on, without the express written permission of GenTrust. © 2025 GenTrust. All Rights Reserved.